Overview

1099Policy offers a CreatorIQ integration that syncs creator information between CreatorIQ and 1099Policy. Creators on the CreatorIQ platform that are required to have either (1) workers compensation or (2) general liability insurance have the option of using 1099Policy platform to procure both types of insurance on a pay-as-you-go basis.

This guide is intended for those already familiar with CreatorIQ’s platform and looking to integrate with 1099Policy. If you’re new to CreatorIQ, visit creatoriq.com to learn more and then return to this guide. The remaining document details the steps required to set up the integration, sync creator information between CreatorIQ and 1099Policy, and generate an insurance application link that creators can complete to procure insurance.

1099Policy Setup

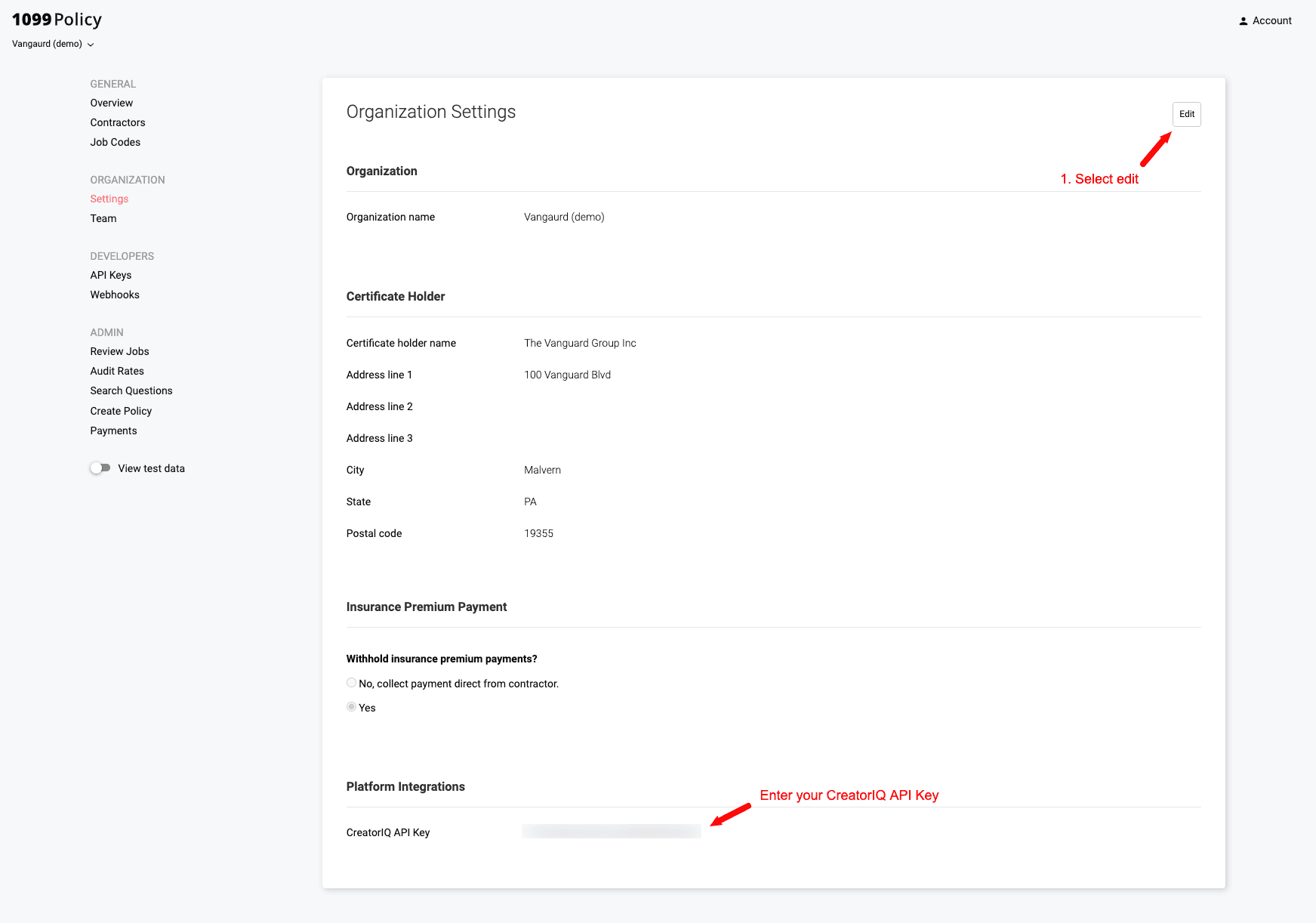

To start, work with your CreatorIQ representative to get an API key set up for your CreatorIQ environment. Once you have your CreatorIQ API key navigate to the “Organization > Settings” section of the 1099Policy dashboard, click “Edit” and enter your API key and click “Save”.

That’s it! After completing the steps above, you have what you need to start syncing creator information between CreatorIQ and 1099Policy.

CreatorIQ Environment

To get the most out of your integration, we’d also recommend adding the following creator attributes which your CreatorIQ rep can set up on your behalf, including:

| Field Label | Custom Field Number | Description |

|---|---|---|

| PO # | CustomField3 | Agency reps that remit payment on the contractors behalf can use this field to pass the purchase order number to 1099Policy. 1099Policy includes the purchase order number in the invoice that's sent to the agency. |

| PO Contact Email | CustomField4 | The email address of the agency rep managing the campaign. Agency reps that remit payment on the contractors behalf are required to complete this field if "Agency Pay" is set to "true". |

| PO Contact Name | CustomField5 | The name of the agency rep managing the campaign. Agency reps that remit payment on the contractors behalf are required to complete this field if "Agency Pay" is set to "true". |

| Agency Pay | CustomField7 | Agency reps using CIQ, in some cases, may decide to remit payment on the contractor's behalf. In those instances, the agency rep will want to update the "Agency Pay" custom attribute to "true”. 1099Policy defaults to having contractors pay by credit card (i.e., “false”). |

| Work State | CustomField8 | The state where the creator intends to do the work. If blank, default’s to the creator’s state of residence. |

| Insurance Exempt | CustomField9 | If “true”, bypass the sync between CreatorIQ and 1099Policy. Default’s to “false” if blank. |

| Base Pay | CustomField10 | The amount the creator is paid less any additional amount that is included to cover insurance costs. Default’s to the “Payment Amount” as indicated under the campaign “Payments” tab, if left blank. |

Note that the mapping between label (e.g., Agency Pay) and custom field number (e.g., CustomField7) matters. If these are set up incorrectly, syncing between these fields and 1099Policy will not work.

Once the CreatorIQ rep has added these fields on your behalf, you’ll want to make sure each field is set to “visible”.

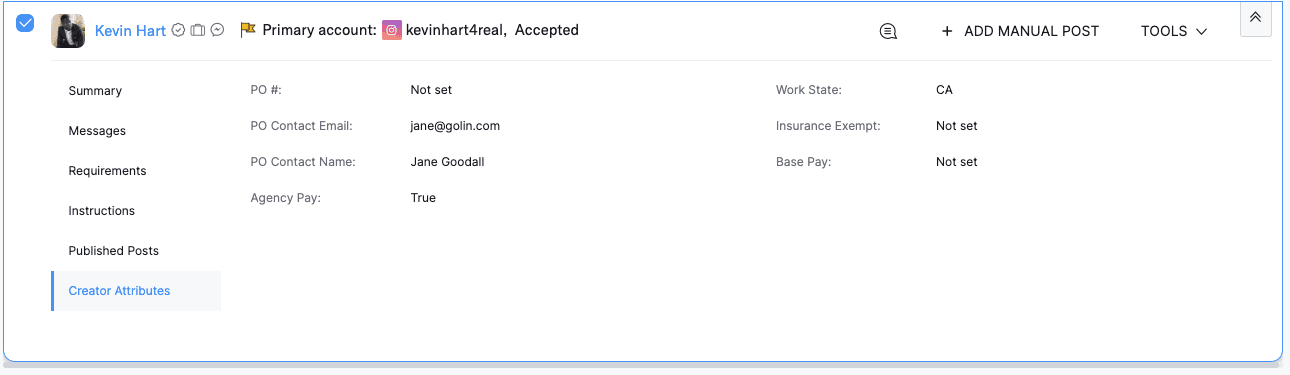

Here’s what the “Creator Attributes” tab shows once these custom attributes are configured. If you don’t add these fields to your environment or choose not to modify them, we’ll default to the values captured under the “Description” column in the table above.

CreatorIQ Workflow

Although you’ll follow many of the same steps you already take to launch a campaign and onboard creators, certain parts of your workflow may need to change for sync between CreatorIQ and 1099Policy to work correctly. In addition to required fields you’ll need to complete in CreatorIQ, you’ll need to ensure certain steps come before others.

Required CreatorIQ Fields

The 1099Policy platform requires, at a minimum, that certain creator information be present in CreatorIQ in order for the integration with 1099Policy to correctly sync and for the platform to generate an insurance application link. The required information includes:

- the creator's address (and in particular their home state);

- the amount creator will be paid;

- the creator's work state; and

- an updated email address

If any of the fields above are missing from the creator’s CreatorIQ profile, the sync between CreatorIQ and 1099Policy will fail.

Note that we ingest other fields as well, including campaign description, and start and end date among others.

Sequencing of Steps

Generally, for information to sync between CreatorIQ and 1099Policy, here’s the order you’ll want to follow using CreatorIQ:

- Create your campaign

- Add you creator/influencer

- Add/Update the creator’s contact information (i.e., address)

- Add the creators payment amount

- Update the custom creator fields (i.e., base pay, etc.)

- Move the creator/influencer to “Accepted”

- Update creators email

The act of moving the creator to “Accepted” (6) then updating the creator’s email (or other personal information like address) (7) is what triggers the sync.

Congratulations🥂, you now have everything you need to successfully sync between CreatorIQ and 1099Policy. You can navigate to the 1099Policy dashboard to see the one or more contractors sync’d as well as the insurance application link. You can find a recording of the entire end-to-end workflow in the video below.

Video Walkthrough

Troubleshooting

If you notice that information between CreatorIQ and 1099Policy isn’t syncing as you expect, you’ll want to look for the following potential issues:

- Campaign start date is in the past – the start date must be set in the future since we use the campaign start and end date to determine coverage start and end date. We can’t issue coverage for dates set in the past.

- Non US-based work state – if the home state is outside of the US and you don’t update the work state in the “Creator Attribute” tab the sync will fail since work state must be in the US and we default to the creator home state if work state is blank. Similarly, if work state is outside the US the sync will fail. Be sure to update the contractor’s city, state, and country of residence in CreatorIQ.

- Missing Creator “Payment Amount” – Check that creator payments is non-zero. Since the payment to the creator serves as the basis for calculating their premium payment, the sync fails when passed a zero or empty value for the payment amount. If you include an amount in “Base Pay” under the “Creator Attributes” tab, make sure you enter only numeric values (i.e., 4500 valid, $4,500.00 invalid)

- Incorrect Sequencing – If you move a creator to "accepted" before updating 1-4 we skip syncing the creator to 1099Policy because we don't have the info we need to generate an insurance application.